How do you measure good investments?

We look at revenue, business model, competitive advantage, management quality, market opportunities, etc. Correct? Be it personal finance or chipping in as an investor, you have done this analysis on some scale.

But what surprises us is, despite all the brains and analysis, no one talks about investing in companies with Intellectual Property (IP).

IP provides legal protection, recurring revenue, and market dominance, yet most investors don’t consider it in their investment evaluations.

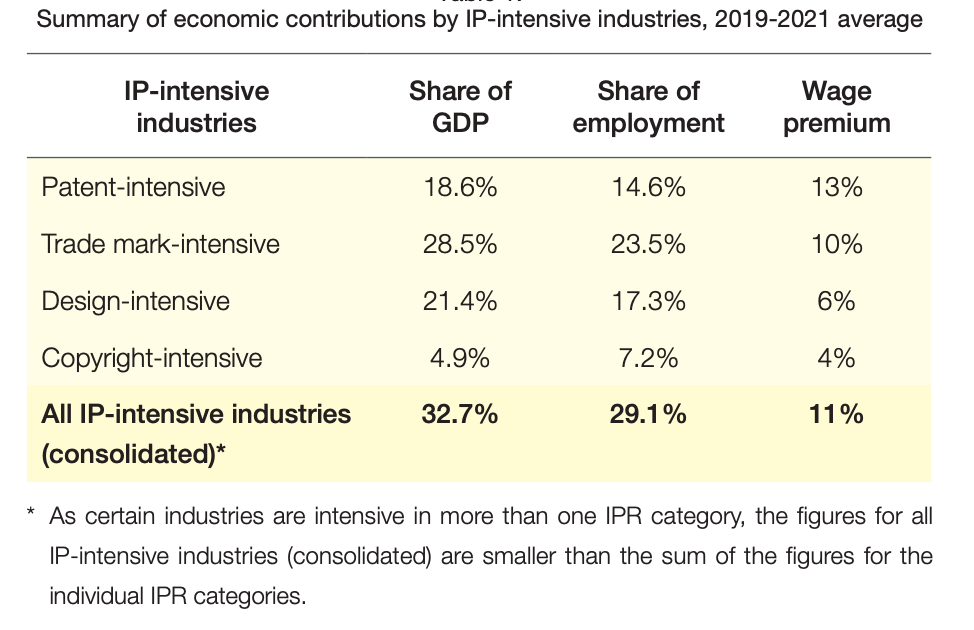

If it sounds too good to be true, Hong Kong’s IP-intensive industries contributed 32.7% of GDP between 2019 and 2021.

The percentage varies from country to country, but it wouldn’t be an overstatement to say “Industries and Companies with IPs are worth investing in.”

We will study how Apple, Dolby, and Disney generate millions in revenue because they own IP, and show why Elf Labs will be the next brand to make it big with their IPs

Imagine owning IP and that’s all you've got to do. You build and own a valuable asset that everybody wants.

The global brands build on top of your IP, and you keep getting a percentage of revenue share because they are using your property.

No active efforts. Massive recurring revenue.

Wouldn’t that provide a great investment opportunity?

We are not kidding.

Here is what Apple does with its IP

Apple’s brand value reached $1.016 trillion in 2024, with 68% attributed to patent-protected technologies like Face ID and A-series chips.

How they do it:

Apple holds 27000+ patents blocking competitors from core smartphone technologies

Multi-touch gestures (protected by 42 patents) created $142 billion in iPhone revenue

The iPhone silhouette trademark prevents clone manufacturers from mimicking the product forms

Dolby maintains huge gross margins with its IP model

Dolby generates 93% of revenue through licensing, maintaining 94% gross margins on its audio technologies.

How they do it:

They have zero scaling cost. Once developed, IP can be licensed infinitely without production expenses.

They gained market control. Dolby Atmos became the cinema sound standard through patent licensing.

83% of Dolby’s licensing revenue comes from automatic renewals in existing contracts.

Disney has a $56 Billion Licensing Blueprint

Disney’s parks and consumer products segment generated $34.2 billion in 2024, with 80% of this revenue tied to IP licensing of characters like Mickey Mouse and Marvel Superheroes.

Its market capitalization of $130 billion directly correlates to its century-old IP portfolio management strategy.

Some key points:

Snow White (1937) copyright generated $665 million in 2024 merchandise sales alone

They established cross-media synergies. Marvel films drive 30% annual growth in theme park attendance.

9000+ licenses pay 12-15% royalties on $39 billion in retail sales.

Now, let us ask you a simple question: If you had known how powerful IPs are and had been aware of Apple, Dolby, or Disney’s IPs during their early days, would you have invested in them?

🧠 Enjoying this so far? Share this deep dive with your friends. Click here to share it on Twitter.

We know the obvious answer.

That’s exactly how we would like you help you today: To identify the next big brand with valuable IP!

Say hi to Elf Labs.

By now, we already know how a brand has a stable, recurring revenue from IPs.

But is owning IPs enough? You might have thousands of properties in your name; what if no one wants them?

We think this is where Elf Labs hits the ground running. They not only have 100+ trademarks and 400+ copyrights but also a proven model, revenue diversification, and so much more.

What makes Elf Labs a promising investment?

Multiple Revenue Streams

You’re not placing your bets on one core vertical; massive advantage! This boosts investors’ confidence because it’s not only safe but also profitable.

Elf Labs is simultaneously targeting multiple, enormous markets:

The Most Promising Venture

We recommend checking out Elf Labs’ newest venture, Elf Mobile. If the IPs and multiple revenue streams weren’t enough, this new product has the potential to be a game changer.

Elf Labs secured a $3.5M development and distribution deal with telecom giant Compax Digital (35M+ subscribers) to build an innovative wireless service. Running on T-Mobile's 5G network, the brand will bring its characters, games, and premium media directly to subscribers nationwide.

“The potential is unmatched” will be an understatement.

“By capturing as little as 0.00018% of market share, Elf Mobile has the potential to achieve a $1B+ valuation.”

Proof of Value

All this isn’t just theory.

We are convinced because Elf Labs has already generated $15 million in royalty revenue without any significant marketing push or technology integration. It shows the IPs’ inherent, timeless value.

Allow us to run some Elf Labs facts for the leaders who love numbers:

$15M in royalty revenue

Three funded franchises; two in production and one in queue

$7M+ raised from 1,800+ investors

Not only this, but the brand has signed multiple large-scale deals with production partners and toy companies that will launch over the next 12-24 months.

All this before their major marketing push even begins. We can’t deny the momentum.

Exceptional Leadership & Team

Let’s face it. We have seen companies with immense potential fail because of poor leadership, which is why the Elf Labs team brings a broad smile to our faces.

To mention a few,

David, CEO, built and scaled a hospitality tech company; raised $20M

The creative department has Emmy award-winning writers from Madagascar and TMNT

Ex-Marvel Creatives who worked on the Deadpool part of Elf Labs production team

The team has previously generated $6B in licensing transactions

The team is full of seasoned professionals who have already succeeded in the exact markets Elf Labs is targeting.

There’s a reason this round is already almost 80% subscribed. Smart investors never lose out on opportunities.

Elf Labs has a limited window left, and they’re giving away 10% bonus shares. Grab them before they disappear at midnight!

This is your day to decide.

This is your chance to become an investor in the most futuristic entertainment tech.

Thanks to Elf Labs for partnering with us to provide this opportunity.

That’s all, team!

That’s it for now 🙂 Stay curious, leaders!

- Mr. Prompts